Brexit Briefing: high tech, life sciences and pharmaceuticals

Regulation and equivalence

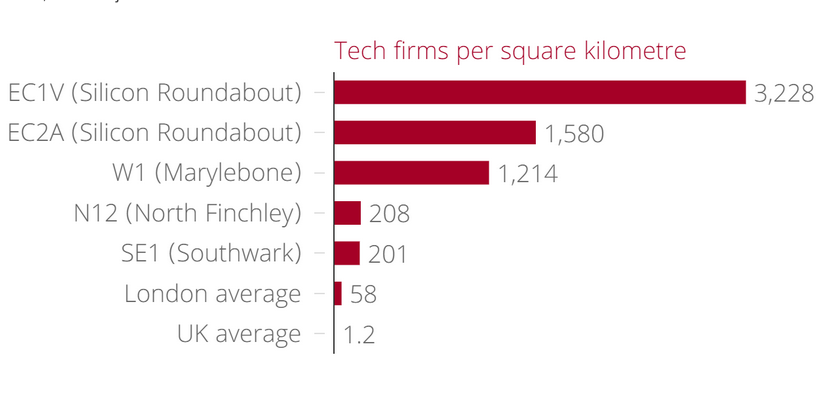

London’s tech sector competes effectively across the world. A recent survey found that London is viewed as one of the world’s top three technology hubs (the other two are New York and San Francisco), and that global tech workers prefer to relocate to London, over other rival tech hubs in Europe such as Berlin and Paris.[1] One fifth (nearly 40,000) of the UK’s tech businesses have headquarters in inner London.

Source: Tech City UK[2]

Tech London Advocates argues that access to the digital single market (DSM) will be critical to the continued success of the tech sector in the UK, and London in particular. The DSM is intended to create an integrated market without barriers between member states based on the use of digital, online technologies and services, making it easier to buy, sell and do business across the EU member states.

The DSM strategy launched in May 2015, underpins the DSM and is the vehicle through which the European Commission intends to achieve digital harmonisation and unlock e-commerce potential.

The DSM strategy is built on three pillars: i) better access for consumers and businesses to digital goods and services across Europe; ii) creating the right conditions and a level playing field for digital networks and innovative services to flourish; and iii) maximising the growth potential of the digital economy. Evolving rules under the strategy are designed to: protect intellectual property; safeguard consumer data; improve cyber-security; eliminate mobile phone roaming charges; and, end country-by-country restrictions on content such as film and TV shows, among other things.

Reduction in roaming charges is one area where the benefits of a digital single market have already been realised. Roaming across the EU became cheaper earlier this year (April), with new maximum charges for UK customers roaming in the EU set at £0.05 per minute for an outgoing phone call. Roaming charges are due to be abolished altogether in 2017.

In the absence of single market access, the UK/London would need to demonstrate regulatory equivalence to secure continued access to passporting rights – the right to do business across the EEA without needing further authorisation in each country. The same would apply to the digital single market.

Post-EU exit, the UK would need to demonstrate equivalence to DSM-type rules or effectively find itself operating outside the DSM. However, the principle of regulatory equivalence is not yet fully tested, is unlikely to be until at least early 2018 when the relevant regulation comes into force, [3] and is likely to be a protracted process as shown in the America/EU negotiations in relation to trading and clearing derivatives, which took over three years to settle.[4]

Operating outside of the DSM could make it harder for UK domestic online sellers to sell in Europe, and multinationals trying to address and sell across European geographies may need to navigate a more fragmented set up in the future. These challenges, plus the probable negative impacts on recruitment, could adversely affect growth in the tech sector. However some experts consider that the DSM is at best aspirational, and could take some years before it is fully legally binding, and that the presence of the UK’s substantial online market will be needed to fully deliver on the aspirations of the DSM.[5]

Life sciences sector – pharmaceuticals

The UK is a global leader in the Life Sciences sector. The sector is wide-ranging; comprising the pharmaceutical, medical technology, medical biotechnology and industrial biotechnology industries. The sector, as a whole, makes a significant contribution to the UK economy generating a turnover of more than £60bn a year, with exports and a trade surplus worth £30bn and £3bn, respectively.

One-third of the sector’s 220,000 jobs are in London and the South East. Pharmaceutical manufacturing employees have the highest Gross Value Added of any high-technology sector – over £330,000 per employee, delivered in part by commercialising new technologies such as genomics, personalised healthcare and Advanced Therapy Medicinal Products.[6]

The UK is currently part of the European Medicines Agency (EMA) that comprises 25% of global pharmaceutical market and facilitates the harmonisation of medicines regulation for more than 500 million patients across Europe. This includes EU member states, and non-EU members of the EEA, Iceland, Liechtenstein and Norway.

The EMA itself, based in London, employs 900 workers. Post Brexit this EU agency and its jobs will have to move to another EU city as its home.

The sector maintains that robust and internationally aligned medicines regulation, underpinned by science, has been essential for protecting and improving public health, bringing advances in medical innovation to large patient populations in a way that minimises delays and cost. Thus it is calling on government to secure a regulatory co-operation agreement between the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) and the EMA, as it considers that this would be the best way to ensure effectiveness and safety, reduce any potential disruption to UK medicines supply, and would make sure NHS patients are best placed to access new medical advances at the same rate as the rest of Europe.

Dr Virginia Acha, Executive Director of Research, Medical and Innovation of the ABPI (Association of the British Pharmaceutical Industry), giving evidence to the House of Lords EU External Affairs Sub-Committee, recently stated that, securing alignment and cooperation with EU medicines regulation should be a primary objective in any EU exit negotiations.[7] The UK having an aligned framework in place for medicines regulation ‘from day one’ of leaving the EU would be important for maintaining drugs availability and supply.

Risks to foreign direct and domestic Investment

Foreign direct investment (FDI) is important to the UK and London economies, raising productivity and consequently output and wages. FDI also stimulates domestic companies to improve, for example, through stronger supply chains and tougher competition.

Outside of the EU, the UK could become less attractive as an investment destination, and its place in pan-European supply chains damaged. Reduced FDI could mean fewer job opportunities, lower productivity growth, poorer living standards and higher public borrowing. On the positive side, the UK has much to offer investors in terms of timezone, language, skills, the legal system and culture. However, ongoing uncertainty over the UK’s exit could blight these positive selling points.

Investment in the tech sector

Venture capital (VC) investment into London technology companies rose steeply between 2010, (the launch of Tech City) and 2015, totalling over ten times the amount of investment first received. VC is now at a record high, according to London & Partners. During the first nine months of 2015, London-based companies secured around 75% ($1.6 bn) of the $2.2bn raised by UK firms, eclipsing the total amount raised in 2014 ($1.3 bn). London’s fintech sector continues to attract record levels of VC investment with a total $554 million raised by September 2015, compared to a total of $487 million raised in 2014.[8]

Russ Shaw (CEO and founder) of Tech London Advocates has stated that the picture on inward investment is mixed, but on balance is holding up. This view is borne out by recent news articles confirming that Facebook, Google and Apple will continue to invest in its UK bases. Facebook is investing in headquarters in London and plans to increase its UK workforce by 500.[9] Google reaffirmed its commitment to UK tech, with plans to expand its workforce from 4,000 to 7,000 by 2020,[10] and Apple is to move its headquarters to Battersea Power Station.[11] However, Russ Shaw suggests that as the period of uncertainty lengthens, businesses may become more cautious, taking a step back to take stock.

While London currently ranks as number one city in Europe for supporting startups and scale-ups,[12] the sector has highlighted concern over the need to incentivise local and regional investors to fund start-ups. As part of a recently announced Digital Talent Programme the Mayor has committed to helping 400 start-ups and small businesses to access higher level skills that will support business growth.[13] Given the pace of growth in the sector it is likely that more domestic investment will be needed.

During a recent trade visit to India, the Deputy Mayor met with senior Indian business leaders and high growth companies. The visit was aimed at strengthening tech and trade links between London and India. Indian companies have shown a strong desire to be part of London’s growing tech sector, with ICT companies representing the largest sector for growth and accounting for almost two thirds (62%) of all investment projects.

Investment in life sciences

The Life Sciences sector contributes considerably to the UK economy through innovation. The sector invests more than any other in the UK on research and development (£4bn in 2014), creating high skilled jobs, stimulating partnerships/collaborations with academia and other sectors, and driving value for the UK. 25% of the world’s top 100 prescription medicines were discovered and developed in the UK, and the largest pipeline of biotech products in Europe are under development in the UK.

Following an EU exit, investment in life sciences will be at risk. The UK has been a net beneficiary of EU funding for research (receiving back €3.4bn more than it contributed to the last Horizon 2020 programme).[14] UK VC is reliant on EU funds (e.g. from the European Investment Bank and European Investment Fund). The Chancellor’s commitment to match fund science and research at the same level following an EU exit, up to 2020 was welcomed by the sector.[15] Though Dr Acha cautioned that in order for the investment to be maximised, enabling UK researchers and academics to continue global collaboration should be a goal of EU exit negotiations.

In London, MedCity, a collaboration between the Mayor and London’s three Academic Health Science Centres – Imperial College, King’s College, and UCL aims to promote life sciences investment, entrepreneurship and industry; and seeks to position London and the south east of England as a world-leading, interconnected region for life sciences research, development, manufacturing and commercialisation to stimulate greater economic growth. Projects such as MedCity are at risk from the uncertainty surrounding the exit from the EU as investors look to invest in more economically stable countries and skilled workers will look to work in cities where they have more long-term guarantees to remain.

Access to talent

There are now 5.7 million jobs in the London labour market. Around 13 per cent of these are held by people born in other EU countries.[16] In comparison, around five per cent of jobs in the UK (excluding London) are held by EU workers.[17] Free movement from the EU has helped businesses overcome skills and labour shortages, and brought valuable talent to London workforces.

London businesses are adamant that any future immigration system will need to remain open and outward looking to attract the best of the talent available across Europe at all levels of employment.

Necessity of talent to the tech sector

The technology sector is a key driver of growth and jobs in the London and UK economies, and research commissioned by London & Partners shows that it will continue to be, over the next ten years. Over 250,000 people are in digital employment across inner London alone, more than any other city in the UK.[18] Around one quarter of UK jobs in computer and related activities across are in London, as are one fifth of all jobs in telecommunications.[19]

Projections show that employment in the sector as a whole will grow by almost one fifth (18.5%) over the next ten years, and the number of digital tech companies in London by a third (33.2%) over the same period. The increase in both the number of jobs and companies in London’s tech sector over the next decade is set to outpace the growth of both the UK-wide tech sector and London’s economy as a whole.

The free-flow of EU talent is, according to Tech London Advocates, crucial to the continuing growth of the tech industry. Together with investment, continued access to talent is another of the sector’s key asks set out in its post-Brexit charter.[20] The sector is concerned to preserve access to EU talent, rapidly grow home talent, and deter the exodus of skilled IT staff. The post-Brexit charter states:

“Homegrown and overseas talent are vital to establish a world-class tech talent pipeline; immigration visa routes and national digital skills training initiatives will form the basis of our post-Brexit tech talent charter.”

Tech London Advocates post-Brexit talent charter calls on the government, policymakers and negotiators to ensure the sectors needs are addressed in the lead up to and after an EU exit, and specifically on skills, to create a nationwide digital skills training initiative to fill the hundreds of thousands of digital roles that will be created in the short-term. The charter also calls for increased diversity and inclusivity creating greater access to talent from all backgrounds and skill sets, as well as an immigration system that helps to address the current tech talent gap and is attractive to entrepreneurs and workers alike. [21]

Cautious optimism remains across the sector, in terms of recruiting to jobs. A recent TechCity UK survey showed that less than a third of businesses were likely to slow down on hiring.[22]

Current efforts to address the skills deficit are insufficient. The newly established ADA, National College for Digital Skills accepted its first intake of students in Tottenham Hale in September 2016. It offers sixth form and higher level apprenticeship education and training and at the end of the academic year expects 1000 students to graduate. This will provide a small, but welcome contribution to help fill the 130,000 vacancies in the UK tech sector that need to be filled every year, at varying stages of the career ladder, bearing in mind that it will take some to train up individuals.

The Mayor’s £7million Digital Talent Programme launched earlier this month, will contribute to reducing the skills deficit. There will be a particular focus on boosting the proportion of women in the industry, which currently stands at just 17%.The programme will support 1,000 young Londoners to access new, industry approved learning opportunities, 2,000 to access better information, sign-posting, and careers guidance, and 500 university students to gain new skills and work experience through small business placements. A range of other support packages, including for business are mentioned. The programme will be funded from the London Local Enterprise Partnership (£5m) and from the European Social Fund (£2m).[23]

Necessity of talent to the pharmaceutical sector

In the weeks following the referendum vote outcome the Government launched a UK EU Life Sciences Transition Programme with a key objective to determine how to create a world-leading life sciences environment in the UK outside of the EU. The programme is spearheaded by a task force made up of government officials and sector representatives. Securing access to the best talent is one of four priorities it has set. The sector maintains that:

“The UK must remain accessible and attractive to the world’s best talent and UK must retain the ability to work in the EU and beyond.”

One of the major reasons the global pharmaceutical industry is drawn to the UK has been the ability for companies (as well as universities and research institutions) to attract, recruit and retain a global highly-skilled workforce. The sector considers that a “needs-based, straightforward, and rapid” immigration system that facilitates ease of movement for talented students, researchers and workers would secure the status of those currently working in UK science, and ensure the UK continues to attract highly-skilled global talent in the future.[24]

Maintaining London’s competitiveness

Ongoing uncertainty over the timetable for exiting the EU, along with the type of trade agreement to be secured, and status of EU workers and, the possible impacts on the various sectors remains. The loss of access to the single market could result in reduced exports, and increased trade barriers, impacting on the competitiveness of UK goods in the EU market. The potential for higher import tariffs and purchasing costs are key concerns for the pharmaceutical sector; for the tech sector, uncertainty around whether it will continue to attract world class talent, and the knock on effect that might have on the continuing development of the industry at pace.

The Prime Minister has said that the UK will “develop our own British model” and will be “the most passionate, enthusiastic and convinced” supporter of free trade in the world after it leaves the EU.[25] She reiterated this stance in a recent India-UK Tech Summit in New Delhi, “We want Britain to be the most committed and passionate advocate of free trade in the world.”

In recent weeks David Davis MP, Secretary of State for Exiting the EU, confirmed that “London’s voice will be heard” through monthly face-to-face meetings between him and the Mayor in the lead up to, and after Article 50 is triggered.

Also in recent weeks the Mayor announced that he is convening a business advisory group, including representatives from the technology, finance and retail sectors, to outline fresh ideas for driving growth amid fears that London could endure economic upheaval if Britain leaves the European single market. Speaking at Bloomberg’s UK investment summit, he said:

“My high-quality Business Advisory Board will bring great insight, innovation and creativity to bear on developing ideas that increase our competitiveness and prosperity, and spread the opportunity that brings to all Londoners.”

The board will meet four times a year, with the Mayor chairing the sessions.[26]

[1] YouGov Research of Global tech professionals commissioned by London & Partners, 2016

[3] Markets in Financial Instruments Directive (MiFID 2). The decision rests with the European Securities and Markets Authority (ESMA), based in Paris.

[4] A similar clause in the European Market Infrastructure Regulation, which governs the trading and clearing of derivatives, was tested between America and EU. It took over three years before American regulations on clearing-houses were deemed equivalent by the ESMA. Financial tonic, The Economist (9 July 2016)

[5] Mark Webber, an international technology and internet lawyer at European law firm FieldFisher, writing in Brexit and ecommerce and the future DSM: what could it mean for you? June 2016

[6] Maintaining and growing the UK’s world leading Life Sciences sector in the context of leaving the EU, September 2016

[7] EU External Affairs Sub-Committee evidence hearing, October 2016

[12] European Digital City Index 2016

[13] Mayor unveils new £7 million fund to help young Londoners access tech jobs, December 2016

[14] The EU Framework Programme for research and innovation

[15] Government announcement issued August 2016

[16] Any reference to EU workers includes those born in EEA countries not part of the EU (Iceland, Liechtenstein and Norway) and Switzerland (neither an EU nor EEA member but part of the single market) as these workers have the same rights to live and work in the UK as other EU nationals.

[17] Annual Population Survey 2015, ONS

[19] London’s digital economy, GLA January 2012

[20] Tech London Advocates: The Post-Brexit Charter

[21] Tech London Advocates: The Post-Brexit Talent Charter

[22] Tech City UK, July 2016

[23] Mayor unveils new £7 million fund to help young Londoners access tech jobs, December 2016

[24] Maintaining and growing the UK’s world leading Life Sciences sector in the context of leaving the EU, September 2016

[25] BBC news, 24 October 2016

[26] Mayor announces Business Advisory Board, November 2016